28 May CREPN #93 – Multifamily Pro-forma Analysis with Beau Beery

Posted at 17:05h

in

Podcast

by J. Darrin Gross

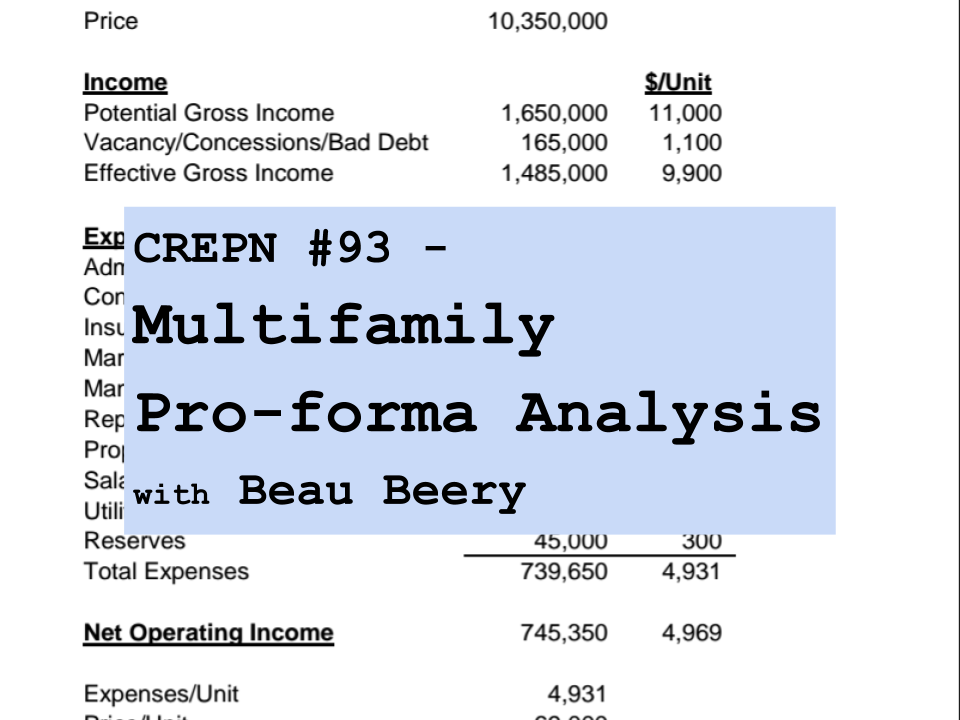

Every real estate deal starts with a pro-forma analysis. The buyer learns quickly if the seller and his broker’s numbers support the asking price.

[x_audio_embed][/x_audio_embed]

If you do not confirm all the numbers, you will be the fool.

Beau Beery is a Commercial Real Estate Broker with Coldwell Banker in Gainesville, FL who specializes in Multifamily. I had the opportunity to review with Beau the numbers and learn what should be present when doing an analysis.

Grab the example used on the call click here.

Beau’s experience has shown there are some primary expenses that tend to be different for the seller and the buyer.

Pro-forma Analysis Expenses

Property Taxes: Property taxes are based off of a tax value, which rarely reflects current market conditions. If the seller has owned the property for a long time, it is likely that the taxes reflected in the pro-forma will be substantially low. It is important to evaluate what the taxes will be when you buy the property.

Reserves: Smaller properties that are managed by the seller will likely either show a low number, or nothing at all. This is where you account for things like new roofs, ac units, paint and parking lots. It’s a real expense, and an easy number to omit, or minimize which will affect the actual performance of the property.

Insurance: The seller’s insurance program is likely not what you will find. The seller could have multiple properties and have access discounts not available to you. Or if the seller does not have a loan, he may elect to self insure.

It is a must to learn, know and evaluate the numbers presented by the seller to make certain your deal will be profitable for you.

For your FREE Deal Workbook to analyze your next property, click here.

For more information go to:

www.beautodd.com

[author title=”About the Author”]]]>